2012 FEDERAL BUDGET PRIORITIES

Executive Summary

Given the current economic realities, setting the right conditions for business success is more important than ever. It is anticipated that the Canadian economy will continue to recover in 2012, but a return to sustained prosperity is far from certain, given the fragile state of the global economy.

The Calgary Chamber of Commerce represents over 3,200 members and seeks to raise the quality and consciousness of public discourse on key issues confronting its members and stakeholders. The Chamber has composed this submission in behalf of its members to assist the government in creating the best environment for business to thrive and contribute to a strong and sustainable economy that encourages investment, wealth creation and a great quality of life for all Canadians.

This pre-budget submission seeks to address those key questions posed by the House of Commons Standing Committee on Finance that align with Chamber member priorities, based on our 2011 annual membership priority survey. These include economic competitiveness, government fiscal management and municipal affairs.

1. How to achieve a balanced budget?

Expenditure Management: Adopt a bandwidth approach to government spending, by targeting expenditure increases within a range delimited by population and inflation growth, and real GDP and inflation growth. This range is between 3.0 and 0.32 per cent for 2011-12, using a five-year average, which means that program expenditures should not exceed $255.8 billion for this fiscal year.

2. How to achieve a sustained economic recovery in Canada?

Increasing Productivity: Amend the Scientific Research and Experimental Development Tax Credit Program to provide public companies and non-Canadian Controlled Private Corporations access to the same 35 per cent investment tax credit on the first $3 million as Canadian Controlled Private Corporations and re-structure the tax credit with the provinces to more closely represent a feefor-service model to provide a more principled and consistent framework for administering and enforcing the SR&ED credit.

3. How to attain a high standard of living?

National Urban Strategy for Canada’s Major Urban Centres: Develop a new fiscal framework that provides greater revenue generating capacity for Canada’s largest urban centers, on a revenue neutral basis, along with sufficient governance, transparency and accountability provisions to better enable these municipalities to deliver infrastructure and services to their constituents.

How to achieve a balanced budget: Government Fiscal Management through a Smart Spending Bandwidth

Federal fiscal policies can have a substantive impact of the competitiveness of the Canadian economy. In particular, the government’s approach to expenditure management, deficit and debt can significantly influence our investment attractiveness and economic performance. The Calgary Chamber of Commerce urges federal leaders to apply prudent fiscal management policies relating to program expenditures and debt levels in order to position the Canadian economy for stable, long term growth.

The Chamber recognizes the federal government’s contribution in facilitating the economic recovery through its extensive stimulus spending campaign during the economic downturn. Federal Government spending increased by 16.4 per cent in 2009, which provided a much needed injection of capital into the economy. However, these increased expenditures also contributed to a record federal deficit of $55.9 billion, which is anticipated to take as long as five years to eliminate.

With moderate economic growth forecast for the Canadian economy in 2011-12, and Calgary business confidence at its highest level since 2008, now is the time for government to re-evaluate its role in the economy. The Calgary Chamber of Commerce encourages government to withdraw stimulus and restrain overall spending, so that Canada may once again rely on business to drive the economy, enabling government to return balanced budgets.

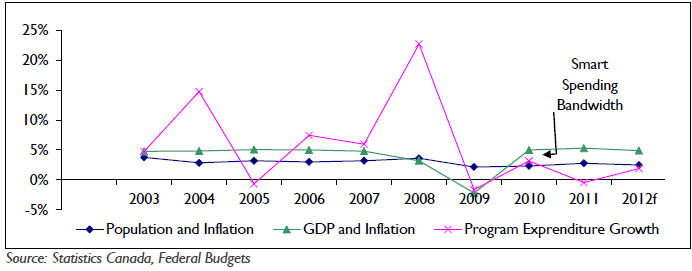

To effectively manage spending, the Chamber suggests that government adopt a bandwidth approach to spending, by targeting expenditure increases within a range delineated by population and inflation growth, and real GDP and inflation growth. However, for 2011-12 this range is expected to be betwee 5.1 and 5.4 per cent (Figure 1), which is relatively high given the sizeable spending increases of the recent recession years. When using a five year average to create a smart spending bandwidth, the range becomes lower: between 0.032% and 3.0%. This is a beneficial approach in that it establishes future spending parameters in the context of the current fiscal climate and spending constraints, and sends a and credible signal to the business community and Canadians that the federal government is committed to returning Canada to balanced budgets.

Figure 1 - Government program spending increase versus recommended bandwidth

The 2011-12 federal budget tabled in March 2011 proposed spending increases well within this range at 0.2%. By targeting the program expenditures to be at the lower end of the bandwidth at about $249 billion while earmarking the remaining amount of $6.6 billion[1] at the higher end of the bandwidth to eliminate the deficit and, subsequently, reduce the debt-to-GDP ratio, Canada will be in an enviable financial position relative to its peers in the international community.

The Calgary Chamber of Commerce recommends that the Government of Canada adopt a bandwidth approach to government spending, by targeting expenditure increases within a range delimited by population and inflation growth, and real GDP and inflation growth. This range is between 3.0 and 0.32 per cent for 2011-12, using a five-year average, which means that program expenditures should not exceed $255.8 billion.

How to achieve a sustained economic recovery in Canada: Increasing Productivity through creating a favourable climate for R&D

With much of the Albertan economy focused on commodity export without adding value to their raw materials, investment in research and development (R&D) is absolutely necessary in expanding productivity. It is well documented that R&D increases total factor productivity and increases competition and innovation, with a rate of return that exceeds traditional methods. The commercialization of R&D innovations and technological developments is also important to enhancing productivity. However, according to the Conference Board of Canada, “Canada does not successfully commercialize its scientific and technological discoveries into world-leading products and services."

A key federal policy lever for incentivizing R&D investment to catalyze productivity growth and capital market democratization is the Scientific Research and Experimental Development (SR&ED) Tax Credit Program. The SR&ED, however, creates differing tax structures, which unfairly penalize nascent public companies. With most public companies based in Alberta and British Columbia (together accounting for 54.5 per cent of the public companies in Canada),[2] this credit unfairly favors the Canadian-controlled Private Corporations (CCPCs) in the east by giving them a 35 per cent investment tax credit (ITC) advantage, for expenditures up to $3 million with 20 per cent ITC on any amounts above $3 million, while public companies and non-CCPCs get only 20 per cent.[3]

Effectively, the tax credit discourages small private companies from becoming publicly owned, inhibiting the democratization of capital markets and wealth creation, and preventing the Canada Revenue Agency from benefiting from the improved disclosure records and audit trails offered by public over private companies. A reasonable and fair approach would be to apply the 35% refundable tax on the first $3 million but not have any refundable portion of ITCs on the expenditures over the $3 million limit, thus providing public companies access to $1.05 million of federal refundable ITCs that can be rolled back into Canadian productivity. It is estimated that a $100 increase in industrial R&D capital increases Canadian industrial output over a range of $32 to $162 (depending on the industry).[4] Using the midpoint of this range ($97), it can be calculated that the positive spillover benefits of the $1.05 million in tax credits per company is about $2.07 million in productivity growth.

Most public Canadian companies are either very large (mostly in Ontario) or very small (mostly in Alberta and BC), with the current regulatory legislation favoring the integrity of the large issuers while placing undue burden on small companies.[5]Companies lose the cash refundable portion of their SR&ED claim when they go public, which is usually put back into R&D. In essence, this approach lowers the amount of money that a small company could use for R&D by tying it up in a limited tax credit that does not offer substantive benefit. In addition, government has been challenged to apply and enforce SR&ED tax framework on a consistent basis.[6] By structuring the tax credit to more closely represent a fee-for-service model (similar to the patent office approach) it would be possible to provide a more principled and consistent framework for administering and enforcing the SR&ED credit, which would strengthen the effectiveness and integrity of the credit system and, consequently, improve its use.

Differential provincial policies also contribute to the challenges of incentivizing R&D investment across the country. All but two provinces provide R&D subsidies on partnerships in addition to the federal program - Alberta and Prince Edward Island (PEI). This differential approach creates regional distortions for R&D investment decisions by: [1] driving investment into other provinces, and [2] implicitly subsidizing other provinces through increases in equalization payments as a result of higher tax revenues generated by offering fewer tax credits.[7]

The Calgary Chamber of Commerce recommends that the Government of Canada amends the Scientific Research and Experimental Development Tax Credit Program to provide public companies and non-Canadian Controlled Private Corporations access to the same 35 per cent investment tax credit on the first $3 million as Canadian Controlled Private Corporations and re-structure the tax credit with the provinces to more closely represent a fee-for-service model to provide a more principled and consistent framework for administering and enforcing the SR&ED credit.

How to attain a high standard of living: Implement a National Urban Strategy for Canada’s Major Urban Centres

Over 80% of Canadians live in Canada’s largest urban centres,[8]which are the main drivers of our economic prosperity and provide a necessary environment for sustained economic progress.[9] As the federal government-appointed Competition Policy Review Panel noted, “large, dynamic urban centres have a national importance that transcends their significance to a region or a province.”[10]

The key component of this strategy to provide support to Canada’s national urban centres must be fiscal reform. While municipal governments service 80% of Canadians, municipal revenues represent approximately 10% of total government revenue[11]. These services that are different in nature and scope from those provided in smaller jurisdictions, such as affordable housing, public transit and other forms of infrastructure, as well as immigrant settlement and support services. In many instances, the federal and the provincial governments have programs to support the provision of these services, but current financial levers are often insufficient for our country’s largest urban centres to provide these services to meet demand.

Municipalities tend to rely primarily on property taxes and grants from senior levels of government as their main sources of revenue - revenue sources that are either not responsive to municipal activities and citizen demand, or create an accountability deficit in that they are at least one-step removed from the taxpayer.

Canada’s largest urban centres need a more stable, secure and growing revenue base established through a framework that ensures sufficient and predictable tax revenues for sustaining municipal infrastructure and operations. Any efforts to provide municipalities with access to greater revenues, however, must go hand-in-hand with those municipalities demonstrating sufficient fiscal discipline through greater transparency and cost controls.

Additionally, current economic conditions, efforts to improve the fiscal capacity of municipalities should not lead to tax increases. Federal and provincial governments are struggling with sizeable deficits and taking actions to reduce their growing expenditures. At the same time, many municipal governments do not approach their budgets with a similar view to fiscal sustainability. Property tax increases in urban centres across Canada have been much larger than the rate of population growth, inflation and/or real GDP growth, and there is little evidence of productivity improvements within municipal government.

Consequently, any new municipal fiscal framework would require that the federal government work with the provinces and cities to eliminate municipal transfers and/or reduce taxes while simultaneously providing cities with new tools to generate their own revenues of equivalent value.

The Calgary Chamber of Commerce recommends that the federal government work with the provinces and Canada’s large urban centers to develop a new fiscal framework that provides greater revenue generating capacity for Canada’s largest urban centers, on a revenue neutral basis, along with sufficient governance, transparency and accountability provisions to better enable these municipalities to deliver infrastructure and services to their constituents.

[1]James Flaherty. “Budget 2011: The Next Phase of Canada’s Economic Action Plan”. Tabled in the House of Commons on March 22, 2011.

[2]Christopher Nicholls. The Characteristics of Canada’s Capital Markets and the Illustrative Case of Canada’s Legislative Regulatory Response to Sarbanes-Oxley. 2006. Page 150. http://www.tfmsl.ca/docs/V4(3A)%20Nicholls.pdf

[3]Canada Revenue Service. “Scientific Research and Experimental Development: About Our Program”. Accessed December 21, 2010. http://www.cra-arc.gc.ca/txcrdt/sred-rsde/bts-eng.html

[4]Jeffrey I. Bernstein, Carleton University and the National Bureau of Economic Research, under contract to Industry Canada, September 1994 http://www.ic.gc.ca/eic/site/eas-aes.nsf/eng/ra00045.html

[5]Christopher Nicholls.The Characteristics of Canada’s Capital Markets and the Illustrative Case of Canada’s Legislative Regulatory Response to Sarbanes-Oxley. 2006. Page 134, 189. http://www.tfmsl.ca/docs/V4(3A)%20Nicholls.pdf

[6]Canada Revenue Agency. “Overview of the Scientific Research and Experimental Development Tax Incentive Program”.4. www.craarc.gc.ca/E/pub/tg/rc4472/rc4472-e.pdf

[7] Kenneth J. McKenzie. “Tax Subsidies for R&D in Canadian Provinces”. Canadian Public Policy- Analyse de Politiques (Vol. XXXI, No. 1, 2005), 38. http://www.ucalgary.ca/iaprfiles/technicalpapers/iapr-tp-05014.pdf

[8]Statistics Canada. Tables: Population, urban and rural, by province and territory. 2006.

[9]The Institute for Competitiveness & Prosperity. Measuring Ontario’s Prosperity: Developing an Economic Indicator System, Working Paper No. 2, 2002, 23.

[10] Competition Policy Review Panel. Compete to Win: Final Report - June 2008 (Ottawa: Government of Canada, 2008), 73.

[11]Kitchen, Harry and Slack, Enid. Trends in Public Finance in Canada. 2006. http://www.utoronto.ca/mcis/imfg/pdf/trends%20in%20public%20finance%20in%20Canada%20-%20June%201.pdf